The Power of Prevention: AMA Insurance’s Risk Management Strategies

The Power of Prevention: AMA Insurance’s Risk Management Strategies

Introduction

In today’s unpredictable world, it is crucial for individuals and businesses to protect themselves against potential risks. This is where risk management strategies come into play. AMA Insurance, a leading insurance provider, understands the importance of prevention and has developed robust risk management strategies to safeguard their clients’ interests.

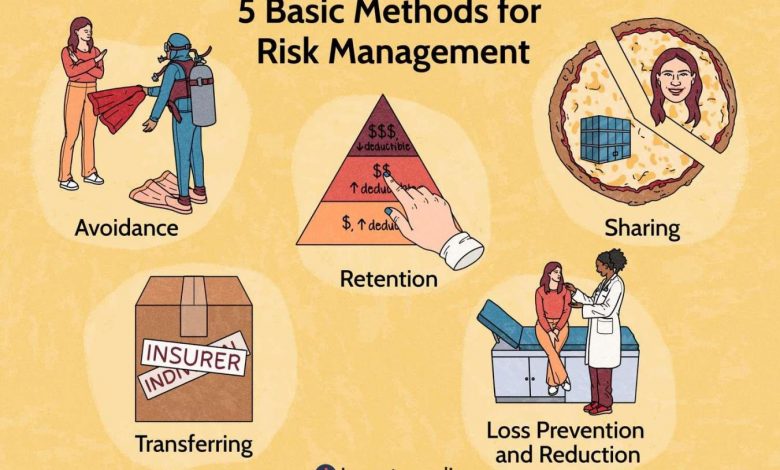

What is Risk Management?

Risk management refers to the process of identifying, assessing, and prioritizing potential risks, followed by implementing strategies to mitigate or minimize those risks. In the insurance industry, risk management plays a crucial role in protecting policyholders from unforeseen events that could negatively impact their lives or businesses.

Importance of Risk Management

Effective risk management strategies can provide numerous benefits to individuals and businesses, such as:

1. Financial Protection: By identifying potential risks and implementing preventive measures, individuals and businesses can avoid significant financial losses.

2. Business Continuity: Risk management ensures the uninterrupted operation of businesses, even during challenging circumstances.

3. Peace of Mind: Knowing that preventive measures are in place can give individuals and businesses peace of mind and allow them to focus on their core activities.

AMA Insurance’s Risk Management Strategies

AMA Insurance prioritizes prevention and takes a proactive approach to risk management. Here are some key strategies they have implemented:

1. Thorough Risk Assessment

AMA Insurance conducts a comprehensive risk assessment for each client to identify potential risks specific to their industry or lifestyle. This assessment takes into account various factors such as location, nature of business, historical data, and industry trends.

2. Customized Insurance Solutions

Based on the risk assessment, AMA Insurance provides customized insurance solutions that cater to each client’s unique needs. This personalized approach ensures that the policy covers all potential risks, providing maximum protection.

3. Regular Policy Reviews

AMA Insurance understands that risks change over time. Therefore, they conduct regular policy reviews to ensure that the coverage remains up-to-date and aligned with the evolving needs of their clients.

4. Risk Mitigation Measures

AMA Insurance not only offers insurance coverage but also advises clients on risk mitigation measures. They provide recommendations on safety protocols, training programs, and other preventive actions that can significantly reduce potential risks.

Frequently Asked Questions (FAQs)

Q1: How can risk management lower insurance premiums?

Risk management can lower insurance premiums by effectively mitigating potential risks. By implementing preventive measures, the likelihood of claims decreases, leading to lower premiums.

Q2: Can risk management eliminate all risks?

While risk management strategies aim to mitigate risks, it is impossible to eliminate all risks completely. However, with the right preventative measures in place, individuals and businesses can significantly reduce their exposure to potential risks.

Q3: How often should risk assessments be conducted?

Risk assessments should be conducted regularly, preferably annually or whenever there are significant changes in the business or personal circumstances. This ensures that the insurance coverage remains adequate and aligned with the current risk landscape.

Q4: What should I look for in an insurance provider’s risk management strategy?

When choosing an insurance provider, look for a company that emphasizes proactive risk management, conducts thorough risk assessments, offers customized coverage, and provides ongoing support to help mitigate risks.

Conclusion

Prevention is undeniably powerful when it comes to managing risks. AMA Insurance’s risk management strategies prioritize prevention and offer clients the peace of mind they need. By conducting thorough assessments, providing customized insurance solutions, and offering ongoing support, AMA Insurance ensures that their clients are well-protected against potential risks. Remember, effective risk management is not just about insuring against losses but also about preventing them in the first place. So, choose an insurance provider with a proactive risk management approach to safeguard your interests.